12 Ways to Maximize Your Value Added Tax Refund When Shopping Overseas Tax refund, Overseas

WorldRemit sends money to 110+ countries for bank-to-bank deposits, cash pick-ups or mobile top-ups. Fetching your data. For a limited time, get $0 fees on your first money transfer from Canada. Conditions apply. MoneyGram has fast cash pick-up transfers to more than 350,000 agent locations worldwide.

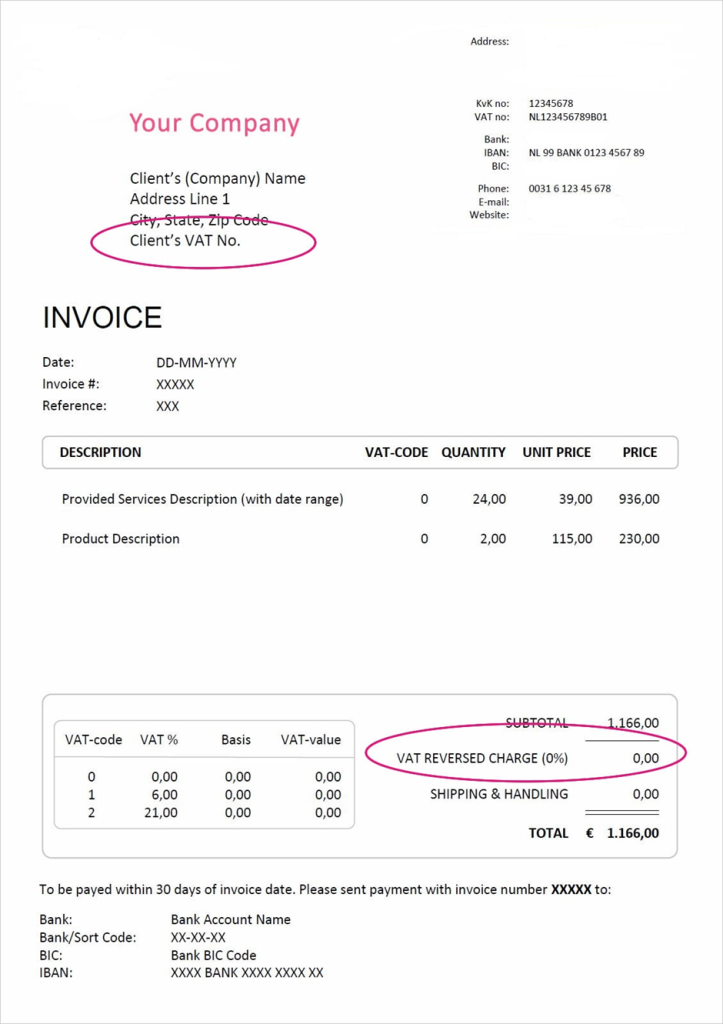

How to issue Dutch invoice Dutch VAT Invoice Requirements

Conclusion. Receiving large amounts of money from overseas can be a complex process, influenced by factors such as tax implications, transfer methods, security concerns, currency exchange risks, and potential delays. By understanding these factors and employing strategies to mitigate risks and streamline transactions, recipients can.

Tax Credits on Overseas of Domestic Taxpayers in Indonesia Schinder Law Firm

A business or financial institution in Canada sends the transaction details to an agent, business or bank in the other country. That agent, business or bank gives the money to the person you're sending the money to (the recipient). Depending on the service, the money may be given as: cash. a deposit into a bank account.

How Your Country's Tax Rate Compares to US and the World Infographic

Gift Taxes on Receiving Amounts. When it comes to large international money transfers, taxes often come into the picture. For example, if a business in the US wired a transfer of US$25,000 to a business in Japan in exchange for inventory, this would result in taxation along the way.

Why the Dutch pay taxes for being wealthy YouTube

If you hold the equivalent of over $10,000 in an overseas bank account at any time during the year, you may need to report it under FBAR - Report of Foreign Bank and Financial Account. You'll have to use FinCEN Form 114 for this report.⁸. Inheritances from abroad which are worth over $100,000 must be reported to the IRS using Form 3520.⁹.

taxes A Dutch salary of 3,000 EUR What is my net? And can I live on that in Amsterdam

You can claim goods worth up to CAN$200.; Tobacco products and alcoholic beverages are not included in this exemption. If the value of the goods you are bringing back exceeds CAN$200, you cannot claim this exemption.

The Netherlands to Introduce Withholding Tax on Dividends

If you receive money from a foreign-based trust, you may need to report it on form T1142, if not immediately, certainly once the estate is administered and you start receiving the money the following year. Understanding the tax implications of your foreign inheritance. As we've seen, tax on foreign inheritances can be complex and costly.

Chart Europe Relies on Taxes Statista

If the U.S. tax on that amount was $7,000 and the Canadian tax on that amount was $10,000, Canada would give you credit on the $7,000 you paid to the U.S. This means you would have to pay an extra.

How Much Money Can I Receive From Abroad? Jeton Blog

To receive an international money transfer made with Wise, the only thing you need to have is a bank account in Canada, in Canadian dollars. The sender will only have to pay a small fee, which they will always see upfront. Wise doesn't add any markup or commission to the exchange rate used, payments are always made with the mid-market.

Best Payroll and Tax services in Netherlands Tax services, Payroll, Dividend

Step 4: Gather documents for your proof of settlement funds. The settlement funds you're required to show while entering Canada don't necessarily have to be on your person in the form of cash, they can also be funds in a Canadian bank account or a bank account in your home country.

How to File Your U.S. Taxes When You Live Abroad and When to Hire a Professional BNC Tax

They are one of the largest family law firms in the Netherlands and work with clients in the Netherlands and abroad in all possible family and inheritance disputes with a personal approach.. Children between 18 and 40 years of age can receive: €26,457 tax-free for any purpose; €55,114 tax-free for an expensive education;

Dutch Tax Return dutchtaxadvice.nl YouTube

Though you're technically surpassing the annual exclusion of 16,000 USD by 2,000 USD per person, you can use the lifetime gift tax exemption to not owe tax. Instead, you'd deduct 10,000 USD from your lifetime tax-free limit. In other words, five times the 2,000 USD you exceeded per person limit.

HOW TO DECLARE YOUR TAXES IN THE NETHERLANDS? 4 STEPS YouTube

Filing a gift tax return. Have you have received a gift of cash? Then in most cases you will have to file a tax return with the Belastingdienst (Tax and Customs Administration) and pay schenkbelasting (gift tax) on the gift. Whether you have to file a tax return depends on the amount of the gift. Last updated on 22 August 2022.

How to File US Taxes Online When Living Abroad (3 Options)

For your income from earnings in Germany you owe tax in Germany and in the Netherlands to avoid double taxation you are entitled to a rebate. In this case the rebate to avoid double taxation would amount to €27,226/€22,690 x €944 = €1,133. But since you only have to pay €944 on your taxable income, the amount of the rebate will only.

Dutch taxes explained 30 ruling YouTube

In the UK, you will not need to pay tax on inheritance if: The estate is valued below £325,000. Any inheritance above this threshold is left to a spouse or civil partner. Anything above the threshold is left to a charity. Find more information on the UK and inheritance tax from the gov.uk website.

Corporate Tax Rates by Country Corporate Tax Trends Tax Foundation

Your parents (Dutch nationality) moved to Spain 8 years ago, but you stayed in the Netherlands. Your parents give you €50,000. In this case, you must file a gift tax return. If you did not use the one-off increased donation yet (in 2022: €27,231), you can still use it. You pay 10% gift tax on the remaining amount.

- Fiat Panda Reclame Jaren 80

- Aanvangstijden Voor Il Primo Giorno Della Mia Vita

- Priscilla Movie Release Date Nederland

- Young Boys Maccabi Haifa Opstellingen

- Jannes Liefde Is Meer

- Nike In Back To The Future

- The Ballad Of Sexual Dependency

- Sarah Thornton Wat Is Een Kunstenaar

- Tokyo Revengers Season 3 Episode 11

- Ride Of The Valkyries Star Wars