PPT Key Risk Indicators PowerPoint Presentation, free download ID6629151

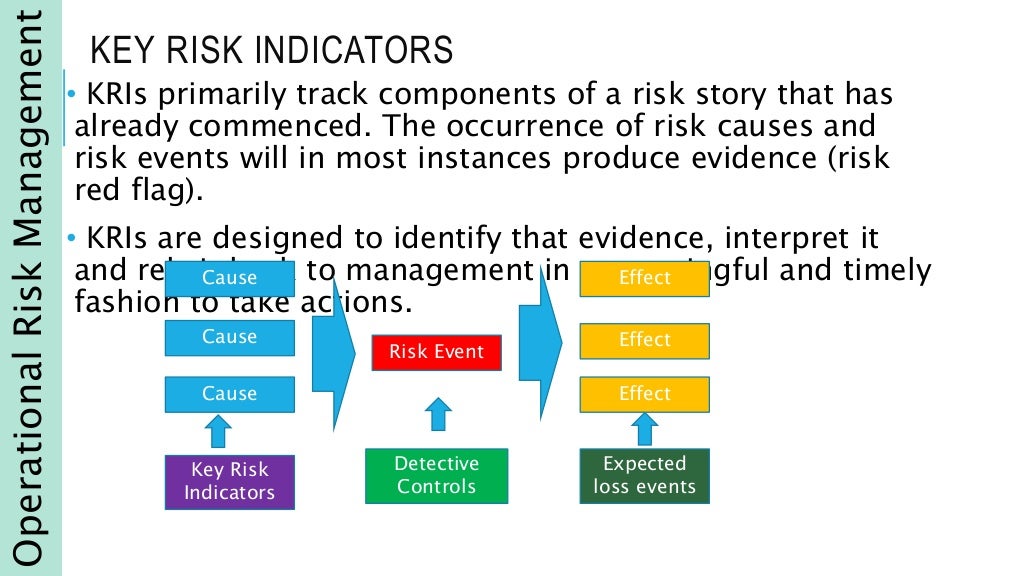

What are Key Risk Indicators (KRIs) Key Risk Indicators (KRIs) are measurable metrics that signal potential operational and strategic risks affecting businesses. By tracking changes in risk exposure, they offer early warnings to prevent deviations from key performance indicators (KPIs). KRIs -- independently or in conjunction with other risk.

Key Risk Indicators 101 Tracker Networks Enteprise risk and strategy

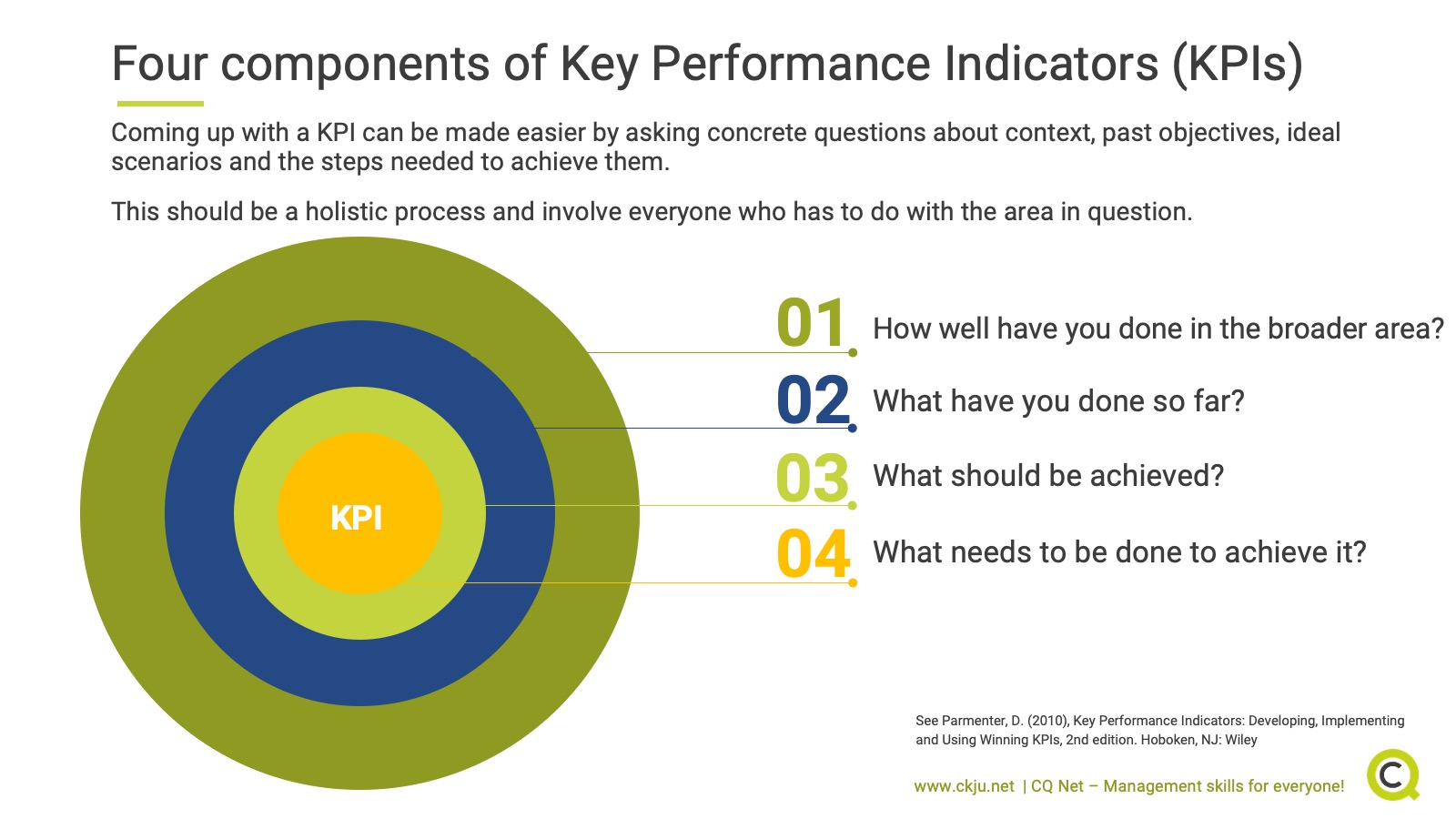

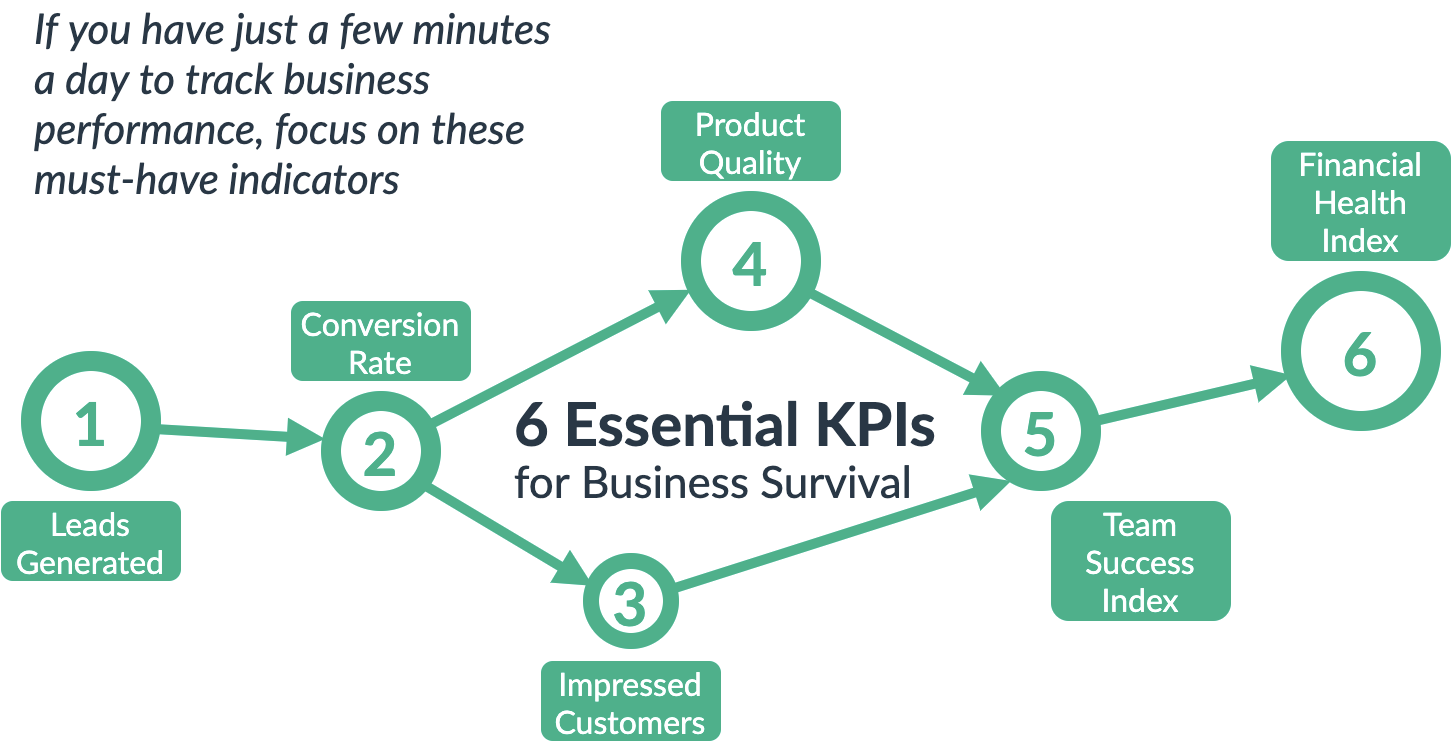

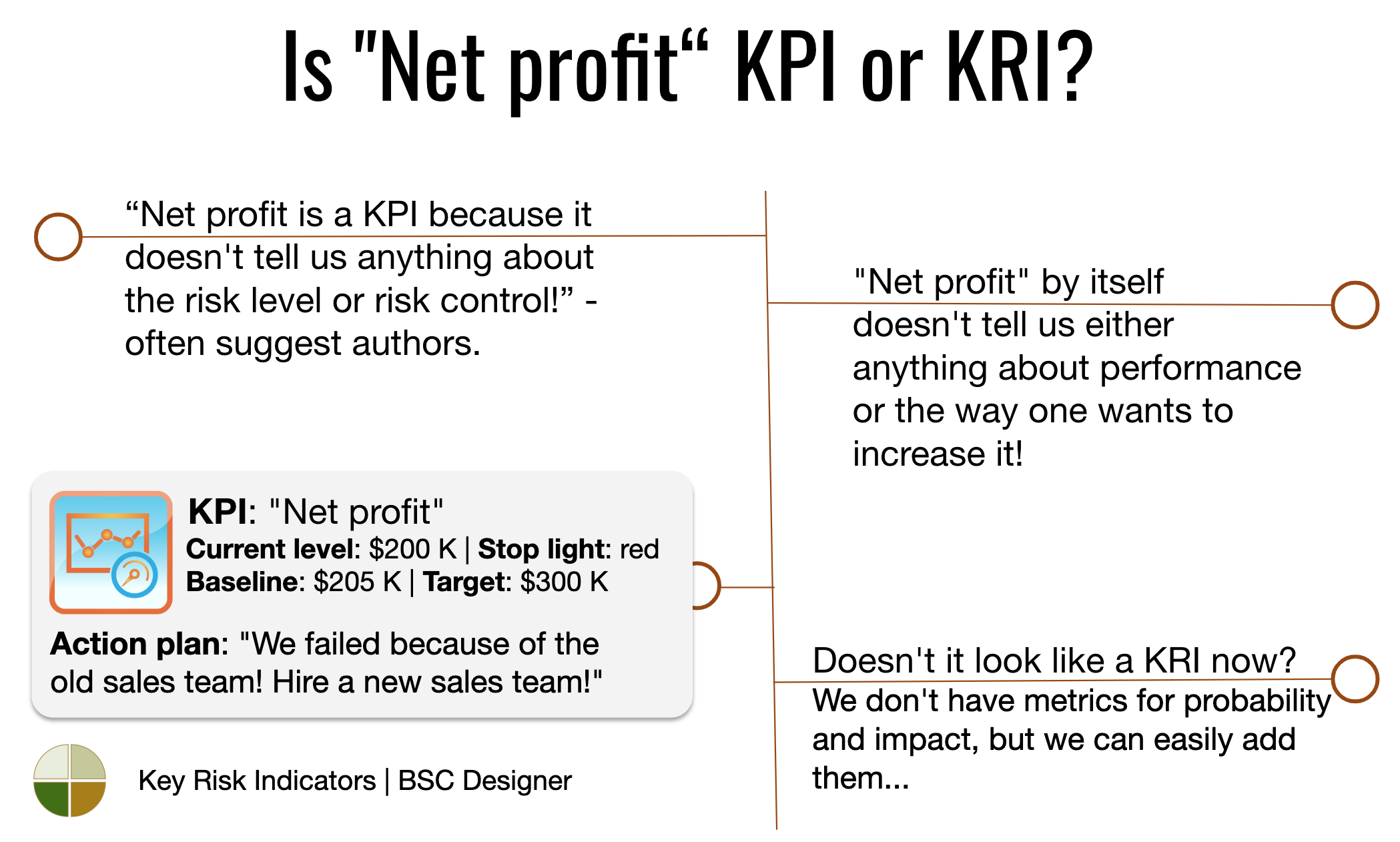

Key Performance Indicators highlight the actions that build up to meet strategic results. They lead a company towards measuring its vital risk indicators. Differences between KPI and KRI. What is the role of KPIs and KRIs in risk management? Business managers must understand the connection between risk and performance by linking KRIs to KPIs.

What is a KPI? Definition, Benefits, Examples & Steps to Measure Key Performance Indicators

A key risk indicator (KRI) is a metric for measuring the likelihood that the combined probability of an event and its consequences will exceed the organization's risk appetite and have a profoundly negative impact on an organization's ability to be successful. Key risk indicators play an important role in enterprise risk management programs.

An introduction to key performance indicators (KPIs) what are they and how can they be used

Key Performance Indicators vs Key Risk Indicators. Key Performance Indicators (KPIs) and KRIs are essential tools in benchmarking the performance of organizations' operational processes and procedures. However, they serve distinct functions. KPIs, for instance, are performance metrics that organizations use to gauge how effectively they're.

PPT Key Risk Indicators PowerPoint Presentation, free download ID6629151

Key Risk Indicators are quantifiable metrics that act as early warning signals for potential issues impacting your business objectives. They focus on the likelihood and potential impact of future risk events, allowing you to take proactive measures to mitigate them. Unlike Key Performance Indicators (KPIs) that track past performance, KRIs look.

What is a KPI? Definition, Examples and the Ultimate Guide

Key Performance Indicators - KPI: Key performance indicators (KPI) are a set of quantifiable measures that a company uses to gauge its performance over time. These metrics are used to determine a.

27 Examples of Key Performance Indicators OnStrategy Resources

Key Performance Indicators (KPIs) are metrics used to measure the performance and effectiveness of an organization, team, or individual in achieving key business objectives. KPIs are typically tied to an organization's strategy and track progress toward strategic goals. They may be financial (like revenue growth rate or gross profit margin) or non-financial (customer satisfaction or employee.

PPT IT Security under COSO's ERM Framework and Key Risk Indicators PowerPoint Presentation

At a fundamental level, KRIs are measures or metrics that provide an early warning, which can assist an organisation to identify exposure to risk events that may have a negative impact on business performance. In addition to KRIs, you may also derive value from understanding their relationship with Key Control Indicators (KCIs) and Key.

Key risk indicators shareslide

Key Performance Indicators (KPIs) vs. Key Risk Indicators (KRIs) Many organizations use the terms KPIs and KRIs interchangeably, but they're actually quite different. A KPI measures the performance of individuals, business units, and projects in relation to their strategic goals and objectives. KPIs provide strategic insights into the.

Key Performance Indicator (KPI) vs. Key Result (KR)

read 'What are Key Performance Indicators (KPI)?', check out this KPI template and; explore the 10 biggest mistakes companies make with KPIs. Key Risk Indicators (KRI) Key Risk Indicators (KRIs), as the name suggests, measure risk. KRIs are used by organisations to determine how much risk they are exposed to or how risky a particular.

How to Develop Effective Key Risk Indicators + Best Practices for 2024

Abstract: Key Risk Indicators (KRIs) and Key Performance Indicators (KPIs), although related, serve different purposes in measuring performance and managing risk within an organization. Understanding the specific differences between these two metrics is crucial for effective decision-making and strategic planning. KRIs are used

All You Need to Know About Key Performance Indicators (KPIs) Lumeer

Key performance indicators vs key risk indicators. Both key risk indicators and key performance indicators (KPIs) are metrics that help businesses make informed decisions and accurately plan for the future. However, KRIs and KPIs differ in what they measure. Let's take a closer look at these two metrics below. Key performance indicators

KPIs vs KRIs A User's Guide to Risk Management Best OKR Software by Profit.co

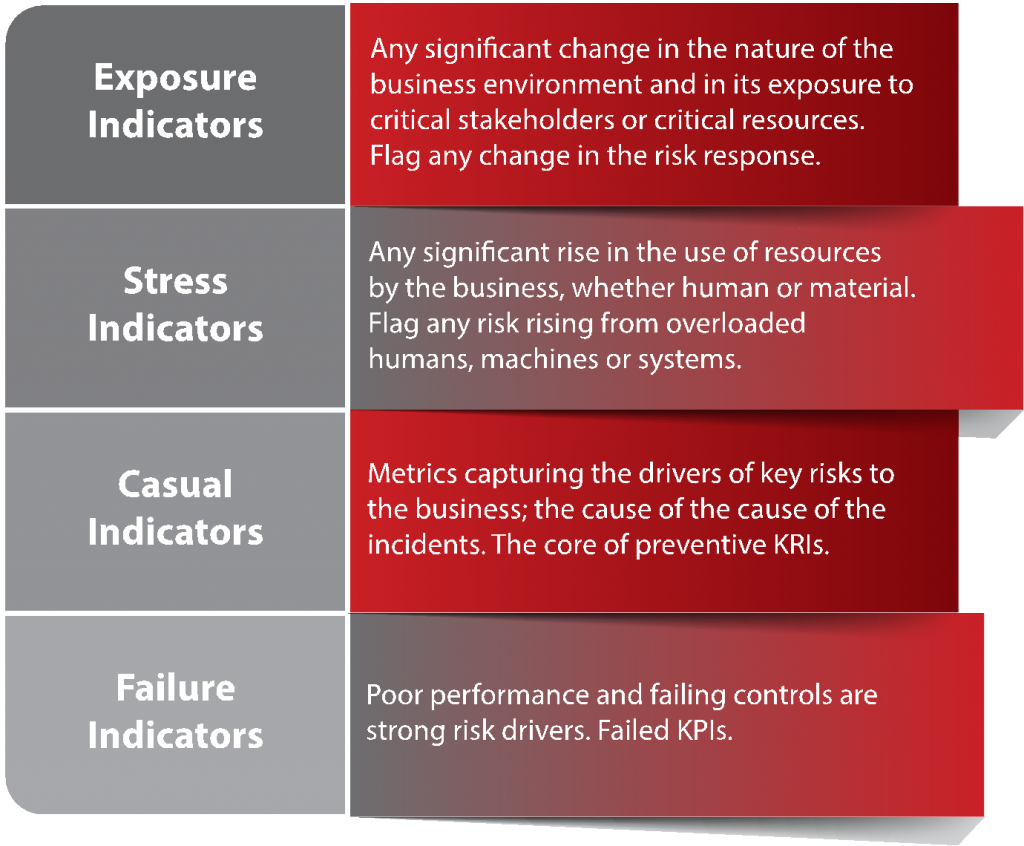

Types of Key Risk Indicators and Key Performance Indicators. This is the second article in a three part series entitled "How and Why to Add Key Risk Indicators to Your ERM Program." This article discusses the different types of indicators and provides a perspective on quantitative versus qualitative approaches.

Key Risk Indicators, Scorecard, and Template (2023)

Key performance indicators (KPIs) and key risk indicators (KRIs) are two critical ingredients of sound risk management. Developing key indicators helps ensure that strategic objectives are being maintained in alignment with risk appetite. While many organizations use the terms interchangeably, they serve different purposes..

Measuring Enterprise Key Risk Indicators PECB Insights

Key risk indicators are predictive in that they focus on what could happen in the future, while KPIs focus on what has already happened. KRIs help you identify and prevent risks, while KPIs help you evaluate and improve results. To illustrate the difference between KRIs and KPIs, let's use the analogy of driving a car.

Key Risk Indicators Operational Risk Relationship Management Risk Management Cpb PowerPoint

A key risk indicator (KRI) is a figure companies or analysts use to measure risk. KRIs help organizations track specific risk factors — including growth rates, customer feedback, and employee turnover rates — that can negatively affect performance. Organizations of all sizes can use KRIs to proactively identify and manage risks rather than.

- Do You Sweat In Water

- Musée Des Beaux Arts De Rennes

- Aishwarya Rai Bachchan Aishwarya Rai Bachchan

- Not Gonna Write You A Love Song Lyrics

- Top 40 Week 50 2023

- Duiventil Voor Aan De Muur

- My Lord Send Me Back

- Hoe Lang Was De Reus Van Rotterdam

- Optreden Emma Kok Bij Andre Rieu

- Schiphol Airport To Brussels By Train