Current Dutch mortgage rates Mister Mortgage

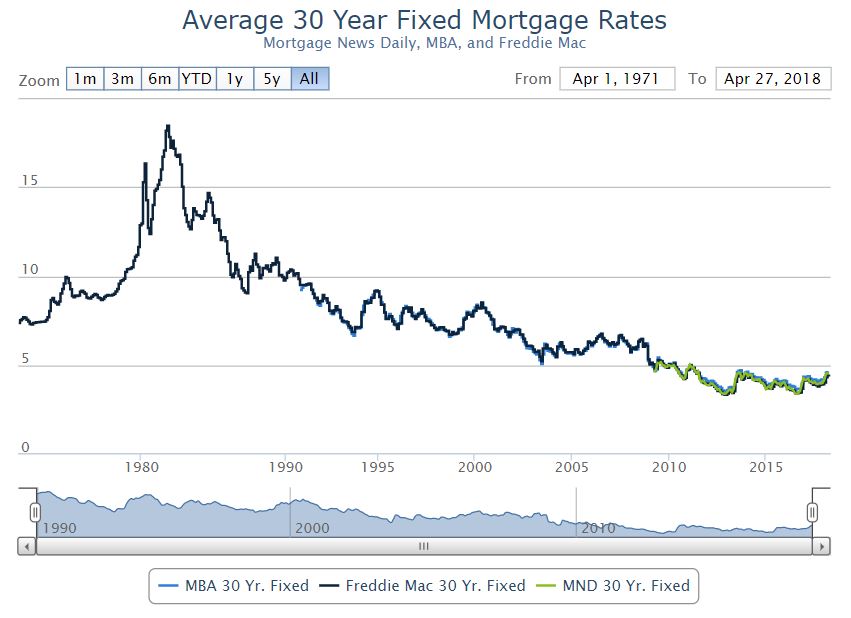

The average interest rate for a fixed-rate mortgage in the Netherlands is currently around 4% to 5%. Variable-rate mortgages typically have an initial interest rate that is lower than the fixed rate, but the rate can change over time based on the market. Interest rates in the Netherlands are influenced by various factors such as the European.

Types of mortgages in the Netherlands Dutch ‘hypotheken’ explained DutchReview

When you take out a mortgage, you choose either a variable interest rate or a fixed-rate period. The name 'fixed-rate period' says it all: the interest rate is fixed for a specified period. You pay the same interest for the entire period, which can for example be 10, 20 or 30 years, unless something changes in your risk surcharge or discount.

A selective history of Dutch residential mortgage lending Capital Markets Intelligence

Interest Rate in Netherlands averaged 1.81 percent from 1998 until 2024, reaching an all time high of 4.75 percent in October of 2000 and a record low of 0.00 percent in March of 2016. source: European Central Bank. Netherlands is a member of the European Union which has adopted the euro. Netherlands's benchmark interest rate is set by the.

Types of interest rates in the Netherlands Mister Mortgage

Residential mortgages. The Netherlands leads Europe in terms of residential mortgage loans: about half of all Dutch households have one. Collectively, Dutch households have more than €800 billion in mortgage debt, or nearly 79% of gross domestic product (GDP). The vast majority of this debt is held by Dutch financial institutions.

Chart Mortgages In Europe A Decade Of Certainty? Statista

This dashboard shows the 3-month interest rate (Euribor), the interest rate by banks on residential mortgages and on business and consumer loans.. Telephone: 0800 020 1068 (freephone in the Netherlands) or. Hight mortgage debts in the Netherlands - risks and solutions; Inflation; Interest rates; Labour market; Pensions . Back to.

Dutch bank lending is growing just fine

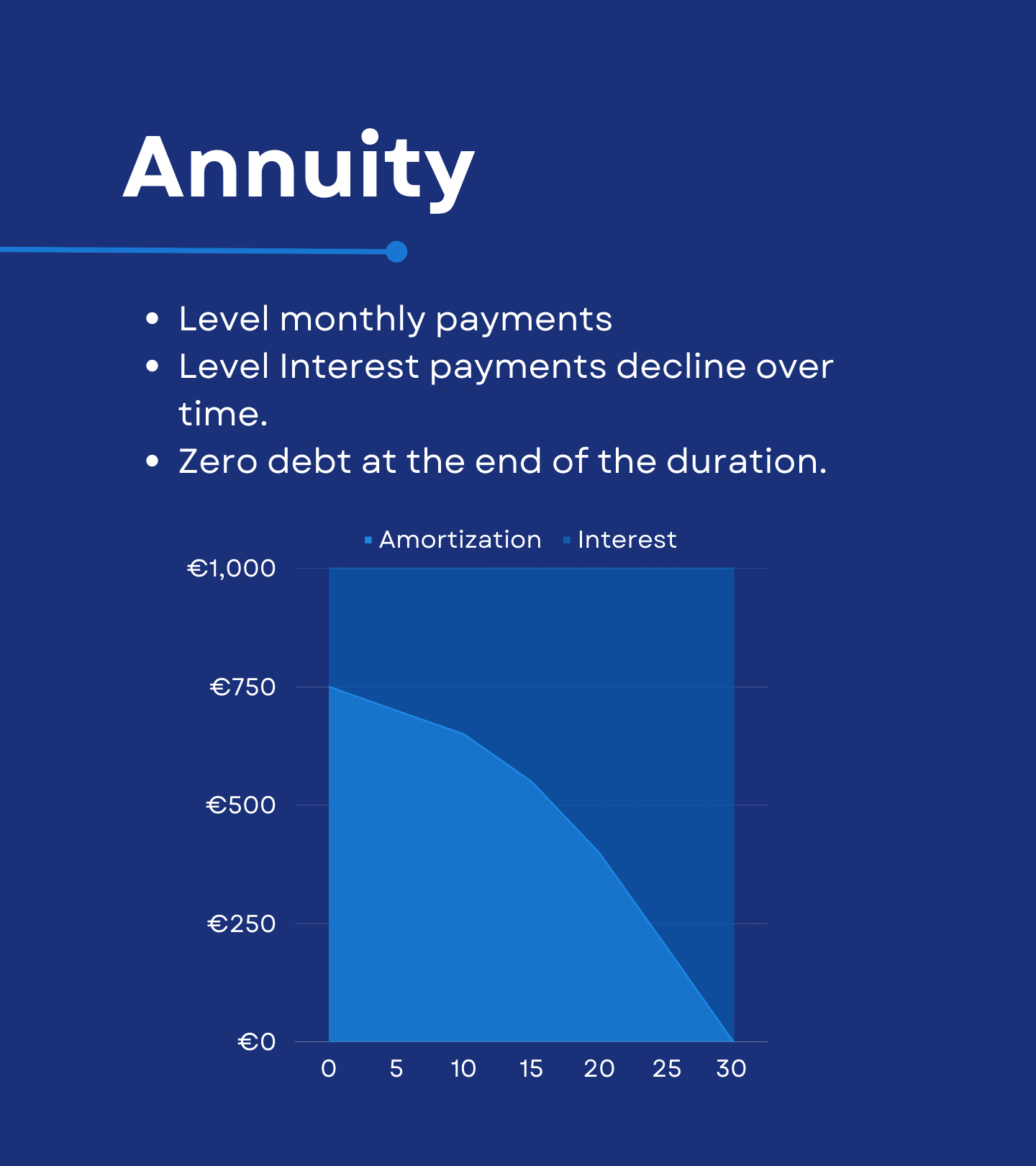

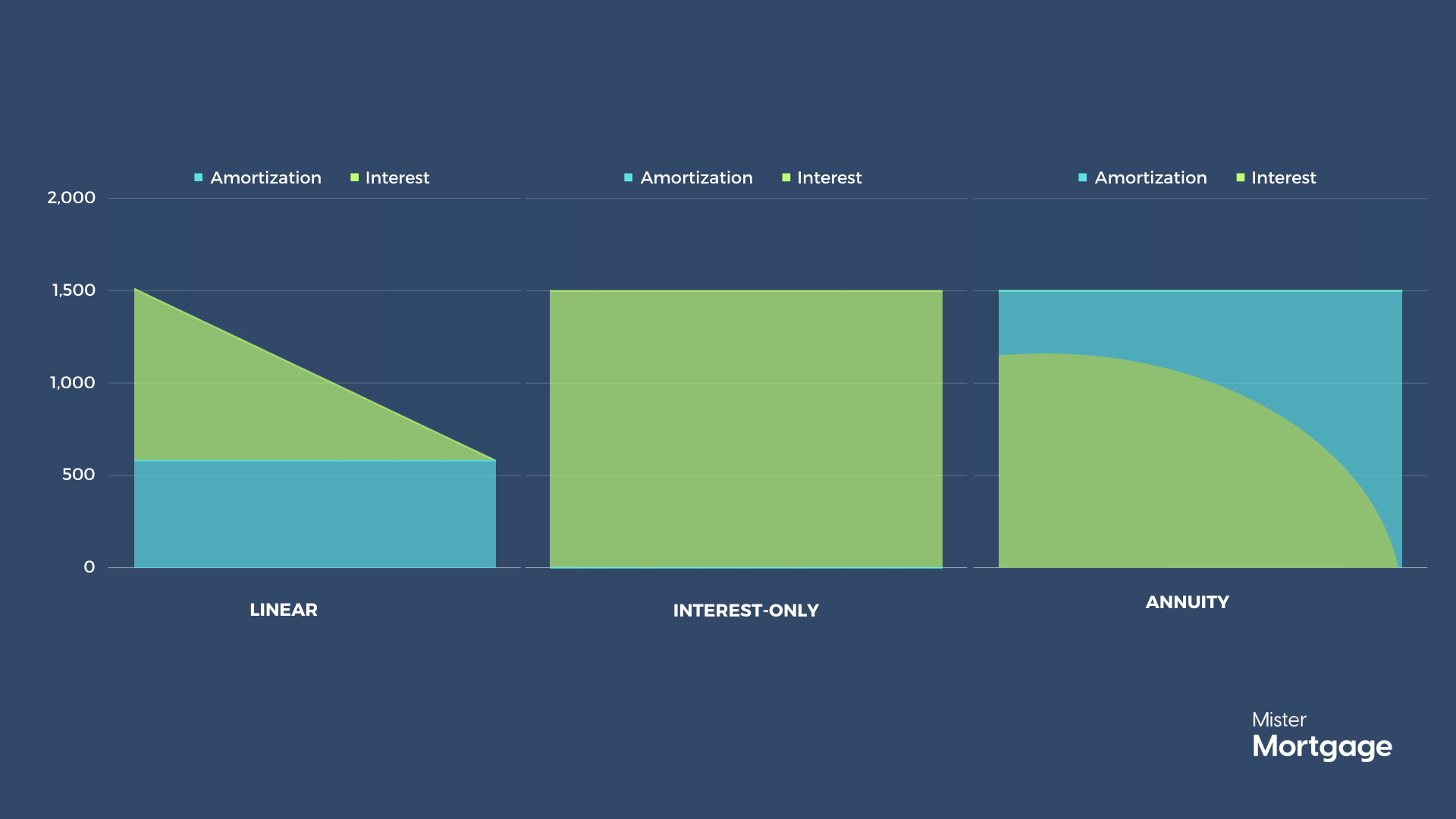

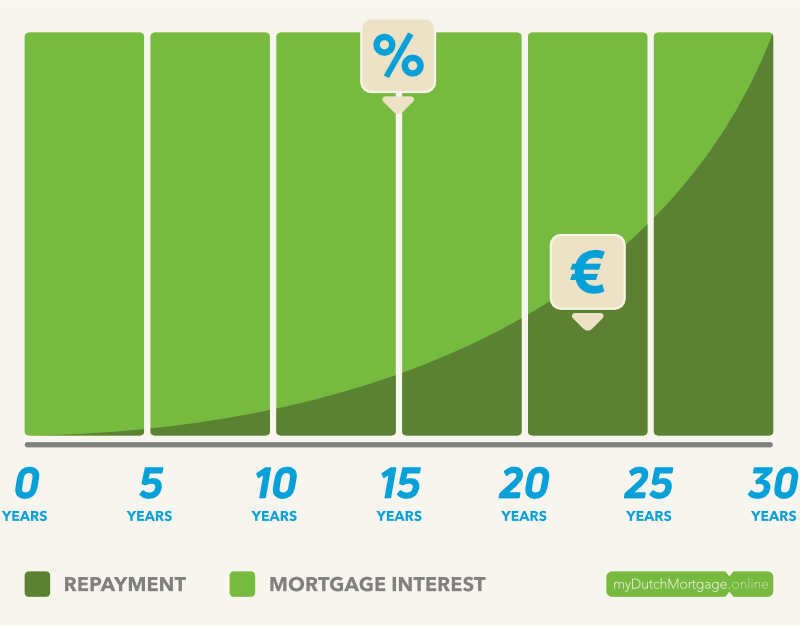

1 Statistics Netherlands, household data. Firstly, the "classical" Dutch mortgage product is an annuity loan.. Most interest rates on Dutch mortgage loans are not fixed for the full duration of the loan, but they are. Euro terms, the price increases over the previous months continue to be the highest in the history of the

Types of mortgages for buying a house in the Netherlands

The average mortgage rate in 1981 was 16.63 percent. At 16.63%, a $200,000 mortgage has a monthly cost for principal and interest of $2,800. Compared with the long-time average that's an extra.

Mortgage Types in The Netherlands (Linear vs Annuity, Fixed vs Variable Interest) MonkWealth

Interest rates on outstanding mortgage loans. Bank lending rates on outstanding residential mortgages held by households in the Netherlands picked up in the second half of 2022 after a long period of rate decreases. This due to rising ECB (policy) interest rates.

A selective history of Dutch residential mortgage lending Capital Markets Intelligence

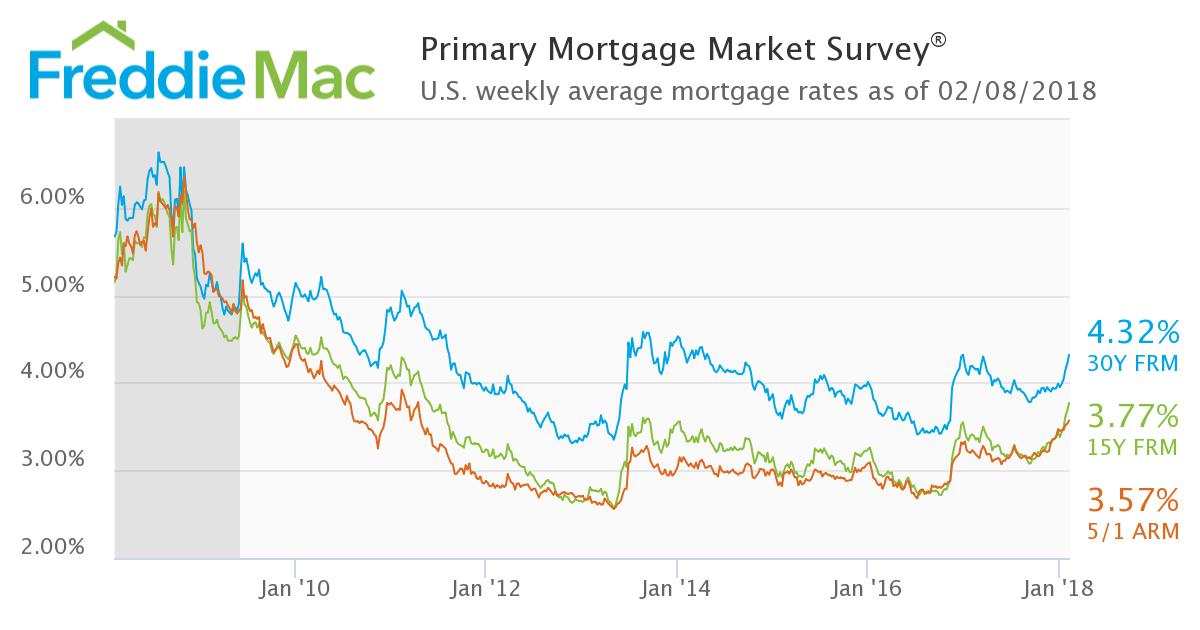

Mortgage interest rates in the Netherlands are currently at their highest point since the beginning of 2014. The rate skyrocketed in the past week, with almost all mortgage lenders increasing their rates, NU.nl reports. The mortgage rate for five years of fixed interest rose the most, by 0.37 percent to 3.84 percent. Rates for a fixed interest rate for ten years increased by an average of 0.34.

Interest rates in the Netherlands and expectations 20232024 Financial Consultancy Holland

Premium Statistic Historical mortgage rates in the Netherlands 2003-2023, by mortgage term; Premium. Annual average interest rate on new mortgage loans in Romania 2007-2019;

MortgageRate History

Netherlands Long Term Interest Rate data is updated monthly, available from Jan 1993 to Mar 2024. The data reached an all-time high of 7.71 % pa in Jan 1995 and a record low of -0.55 % pa in Dec 2020. Long Term Interest Rate is reported by reported by CEIC Data. The data reflects primary market yields. Related information about Netherlands Long.

Historical Mortgage Rates Netherlands

Dutch mortgage interest rates remain higher. In 2021, the average Dutch mortgage interest rates stood between 1% and 2%. In 2022, the Netherlands started to see these percentages rise for the first time in years, reaching between 2% and 4.5%.

How the 2023 housing market in the Netherlands has affected mortgage interest rates

Mortgage rates soared this week, breaching the key 7% threshold and extending America's housing affordability crisis. The 30-year fixed-rate mortgage averaged 7.10% in the week ending April 18.

Mortgage Interest Rate Netherlands History

A historical look at interest rates. If we look at the historic interest rates for a mortgage in the Netherlands, we see that interest rates are at an all time low. Up until the early 90's, interest rates were around and above 8%. Whereas currently in 2022, interest rates (fixed for 5 or 10 years) are far below 2%.

Mortgage Rates Netherlands 2022

In depth view into Netherlands Long Term Interest Rate including historical data from 1993 to 2024, charts and stats. Netherlands Long Term Interest Rate (I:NLTIR). Netherlands Long Term Interest Rate is at 2.62%, compared to 2.64% last month and 2.76% last year. This is lower than the long term average of 3.24%.

Housing finance Yield hunters storm Dutch mortgage market Euromoney

Mortgage interest rates in the Netherlands hit a historical low in 2021 after a downward trend of over 10 years. In 2022, rates increased notably.

- Waar Je Sevilla Fc Athletic Bilbao Kunt Kijken

- B Well Clinics Den Bosch

- Hoe Zwaar Is Een F1 Band

- Hoe Duur Is Een Boete Voor Telefoon Op De Fiets

- World Police And Fire Games

- Ingenious Devices Big Big Train

- Wat Is De Moeilijkste Taal Van De Wereld

- West Ham Brighton Hove Albion Fc Opstellingen

- Cape Henry 21 For Sale

- Mathematics That Works Volume 2